As a finance manager, Madam Ong Sin Hong is familiar with managing money. Yet the 58-year-old came within a whisker of falling for a scam.

She received a call from a scammer posing as a colleague. He wanted money to finance his business.

“It sounded so real,” says Madam Ong, who became suspicious after checking with other colleagues.

To ensure that her retirement savings would be protected from future scam attempts, she activated the Central Provident Fund (CPF) withdrawal lock in January.

“I was worried that tech-savvy scammers might use malware to steal information on my handphone, or even access my CPF savings,” says Madam Ong, citing recent cases in the news.

“I’m more risk averse at my age, so it definitely makes it safer.”

Activated through the CPF website, the feature disables online withdrawals entirely. To re-enable online withdrawals, members can increase their daily withdrawal limit, which requires enhanced authentication and a 12-hour cooling period.

Alternatively, they can submit a withdrawal application in person at a CPF service centre, with monies deposited into a member’s bank account within five working days.

The CPF withdrawal lock is among the additional security measures introduced by the CPF Board late last year to help members safeguard their CPF savings from scams.

These include a default daily online withdrawal limit of $2,000 for members aged 55 and above, enhanced authentication measures, and a 12-hour cooling period when members update their contact details. Updates to bank account details will only occur after the bank has verified that the account belongs to the member.

For Madam Ong, the withdrawal lock has an added benefit – to help her avoid acting impulsively on attractive investment opportunities. “It gives me time to think before I make a withdrawal.”

Promises of profit

CPF members may draw on their CPF savings from age 55. But they should be wary of investment scams targeting their retirement nest egg, says Police Superintendent Matthew Choo, assistant director of the Scam Public Education Office, Singapore Police Force.

“The amount in CPF balances tends to be more substantial for those in this age group,” he says, adding that investment scams can come in different forms. “Key deceit lies in the (promise of) lucrative returns, which is what attracts the victims.”

Latest police figures show that over 4,000 investment scam cases were reported last year, with more than $200 million lost. On average, about $50,700 was lost per case, the second highest among the top 10 scams reported last year.

While less than 1 per cent of the cases reported involved CPF withdrawals, “CPF Board takes these cases very seriously”, says Ms Stephanie Ng, director of Retirement Withdrawals Department, CPF Board.

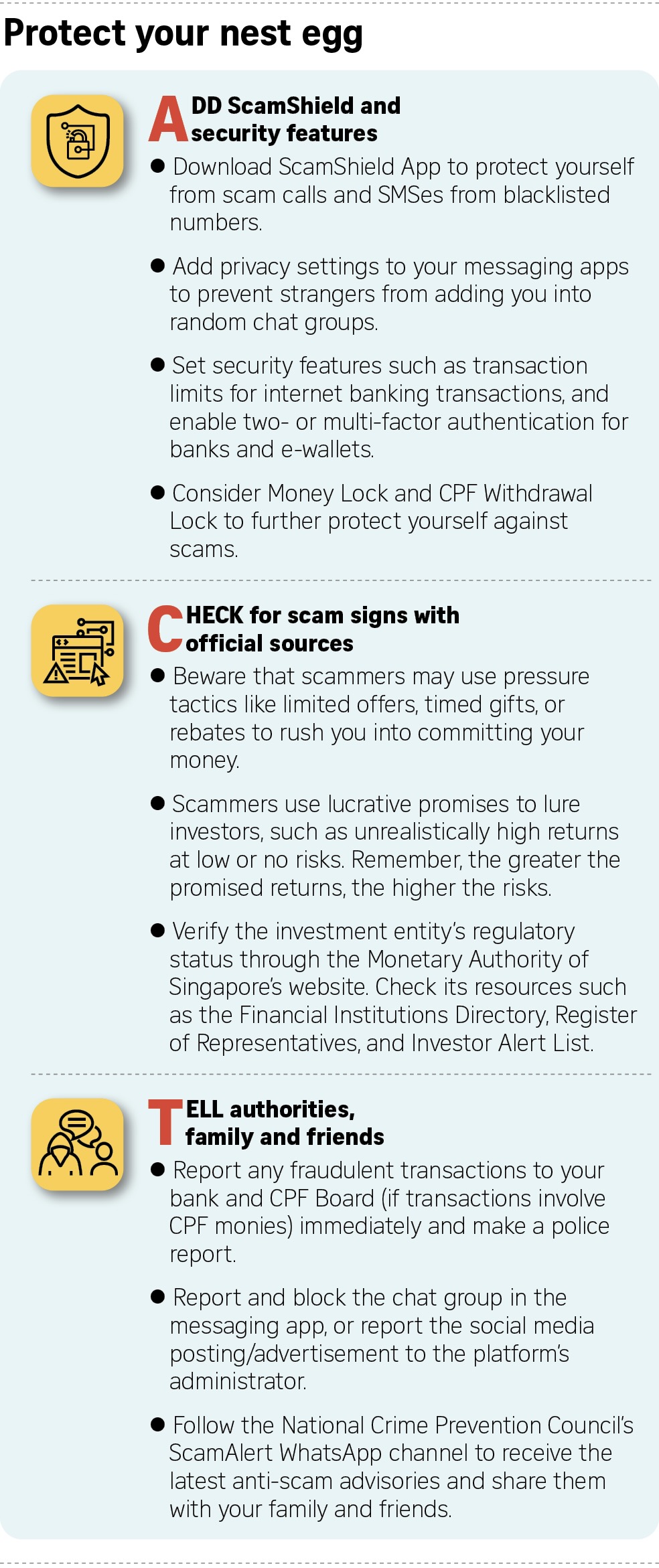

She adds that while these safeguards create friction for scammers and help to reduce losses, “it is important for members of the public to remain vigilant and stay up to date with the latest scam tactics”.

“Exercise caution when approached by individuals who encourage you to withdraw your CPF savings for seemingly attractive investment returns.”

This is part of a series titled "Act against scams", in partnership with the Singapore Police Force.