Q: Where will my monthly payouts in retirement come from: CPF Life or the Retirement Sum Scheme?

A: It depends on whether you are on the Retirement Sum Scheme (RSS) or CPF Life, a national longevity insurance annuity scheme. RSS members will receive monthly payouts from their Retirement Account (RA) until their savings are depleted, whereas CPF Life members will receive monthly payouts for as long as they live.

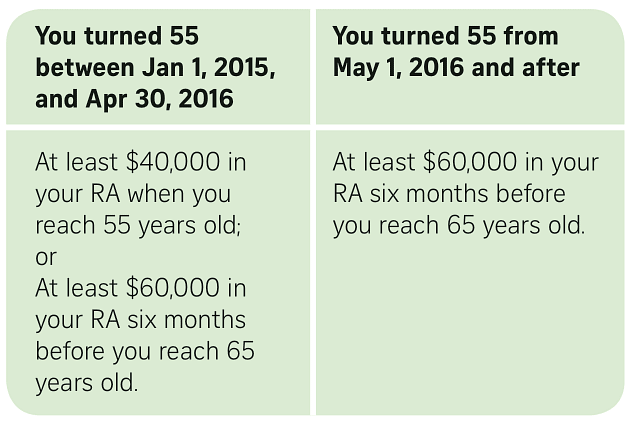

If you were born before 1958, you will be on RSS. If you were born from 1958 onwards and have the following RA balances (left), you will join CPF Life.

If you are not on CPF Life, you can apply to join anytime between your payout eligibility age and a month before you turn 80.

Follow the steps below to join CPF Life:

- Log in to my cpf Online Services with your SingPass

- Click on My Requests and apply for CPF Life

Q: How much do I get in CPF Life monthly payouts when I retire?

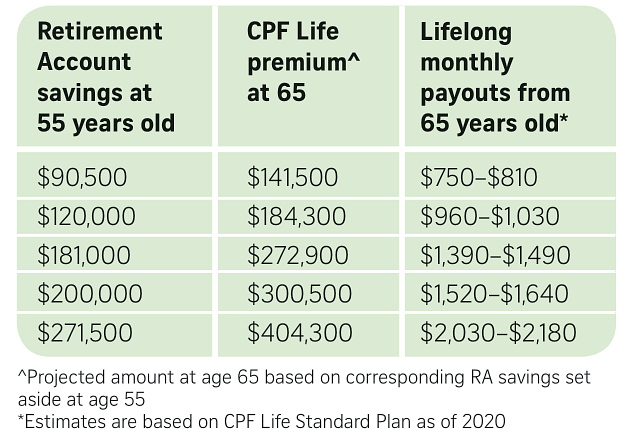

A: Your monthly payouts would depend mostly on the amount of premium that you paid with your CPF retirement savings to join CPF Life.

The amount you receive in monthly payouts generally increases if you set aside more in your RA. For example, if you turn 55 in 2020, these will be your estimated CPF Life payouts (left), based on the RA savings you have set aside at this age and the CPF Life premium you eventually pay at age 65.

To increase your monthly payouts, you can also consider topping up your RA or deferring the start of your payouts.

Use the CPF Life Estimator to find out how much you need in your RA to receive your desired monthly payouts or how much you could receive monthly under the different CPF Life plans.

Q: Does my CPF Life premium continue to earn interest after I start my payouts?

A: Yes, you will continue to earn interest on your CPF Life premium. As a result, you will see a higher monthly payout. As with any other annuity product, interest earned on the premium is accumulated and shared to allow you and other CPF Life members to continue receiving lifelong monthly payouts even after your CPF Life premium is depleted.

Q: I am now 57 years old and have met the Full Retirement Sum in my Retirement Account. Can I transfer some of my money from the Ordinary Account to Special Account as it earns a higher interest?

A: When you turned 55 years old, your RA was created using savings from your Special and Ordinary Accounts to form your retirement sum.

Hence, top-ups - whether in cash or through CPF transfers - to the Special Account are no longer applicable after you turn 55 years old.

If you would like to enhance your retirement savings, you can transfer your Special or Ordinary Account savings to your RA. The maximum amount you can transfer is capped at the Enhanced Retirement Sum for the year.

Q: Should I leave my savings in my CPF account or invest them?

A: The CPF Investment Scheme (CPFIS) is for those who have both the knowledge and the time to invest and are prepared to take the risks. You can try the CPFIS Self-Awareness Questionnaire to help gauge your readiness to invest your CPF money.

The CPFIS gives you the option of investing part of your CPF savings in various instruments, such as insurance products, unit trusts, bonds and shares, to diversify and potentially grow your retirement nest egg. However, all investments come with risks and you may lose some or the entire amount invested.

If you are not confident of investing on your own, you may consider leaving your money in your CPF accounts that earn risk-free interest of up to 5 per cent per annum for those below the age of 55 and up to 6 per cent per annum for those 55 years old and older.

Q: What happens to my CPF savings after I die?

A: After you die, your CPF savings, by default, will be distributed to your beneficiaries in cash.

If you made a CPF nomination, your CPF savings will be distributed to your nominees. Otherwise, it will be transferred to the Public Trustee's Office to be distributed in cash to family members according to Singapore's intestacy laws or Muslim inheritance laws.

Learn more about CPF transfers and top-ups here.

Brought to you by